Review the California real estate market’s performance in the second quarter of 2018 with Voit Real Estate Services’s indispensable Q2 2018 market reports.

Vacancy remains critically low and transaction activity continues to decline, as more industrial businesses are forced to renew existing leases or stay in owned facilities that may no longer meet their needs. This is the current reality and we expect little to change going forward.

Low vacancy creates challenges that go beyond the obvious lack of choice. Increasingly, we are running into timing issues once a property is identified and put under contract.

Most buildings being marketed for lease or sale are still occupied during the marketing period, which is reflective of the slight rise in the Availability Rate that includes available space that is either vacant or currently occupied. In many instances, existing occupiers are unable to vacate properties due to delays in occupancy of their new locations.

We call it the “Domino Effect” and we put all our clients on notice to prepare for delays by negotiating occupancy extensions in existing buildings, or extending delivery times for new equipment that will be installed in new facilities.

On a more positive note, mortgage rates have not increased to the degree expected pursuant to the reversal of the Fed’s easy money policy. Early in Q2, the yield on the 10-Year T-bill, the benchmark for setting commercial property mortgage interest rates, shot up to 3.1%, its highest level in years.

Many experts saw that move as long overdue and talk of much higher mortgage rates increased. However, the long bond yield is influenced by a variety of economic indicators, including global economic outlook, which cooled during Q2. Wary investors from around the world turned more to the safety of long term US Treasuries, which brought yields back down again.

The good news for owner/users and investor borrowers is that mortgage interest rates will hover near current levels for the time being.

If you are a property owner, you still have the upper hand, whether your property is for sale or lease.

You can push for higher lease rates, more robust annual increases and you can pretty much say no to free rent and requests for tenant improvements.

If you are a prospective buyer or tenant, be prepared at all times to jump on the right opportunity, as supply will remain thin for the foreseeable future. You will pay more and probably get less. So, this is a time when every business owner needs to take a long hard look at alternate ways to increase efficiency and create opportunity for revenue growth.

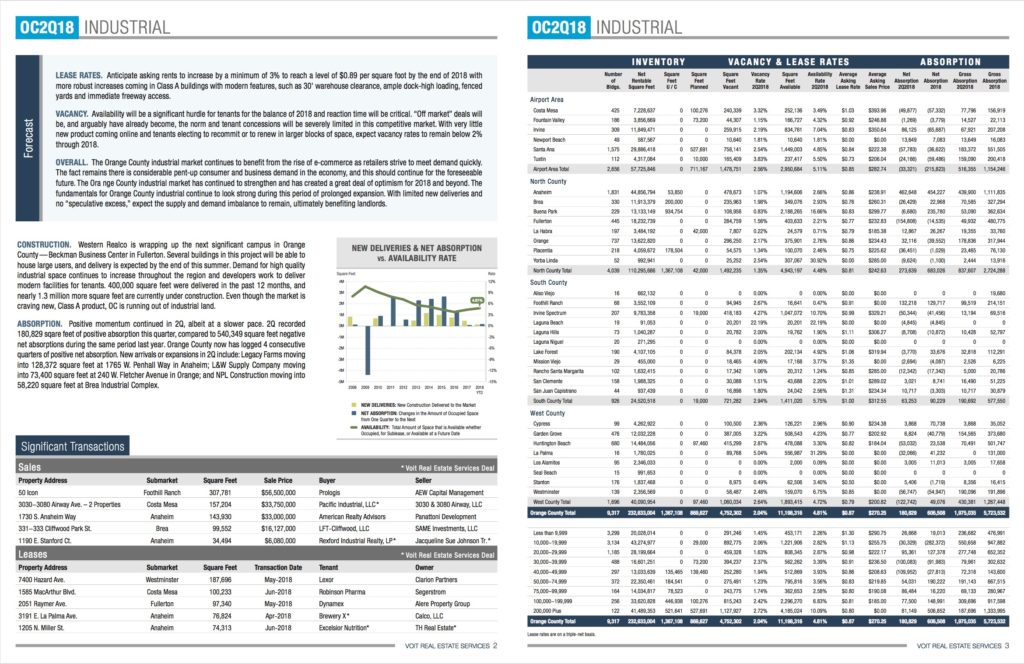

ORANGE COUNTY – INDUSTRIAL

This in-depth market report rounds up the performance of the Orange County industrial markets in the second quarter of 2018.

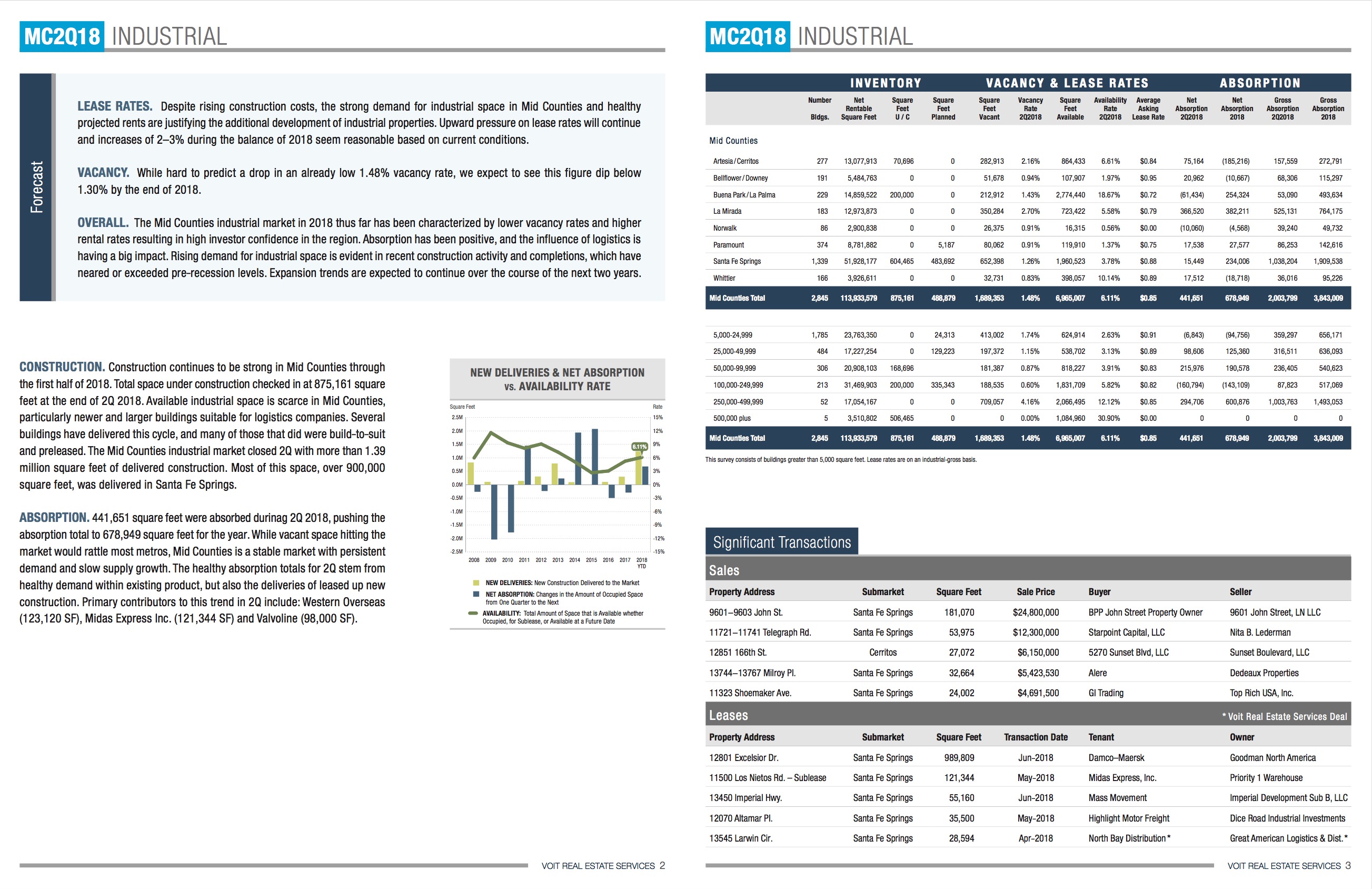

MID-COUNTIES – INDUSTRIAL

Download our fully-illustrated and graphed Q2 2018 report for the mid-counties industrial market via the button below.

More:

Leave a Reply

You must be logged in to post a comment.