Review the California real estate market’s performance in the first quarter of 2018 with Voit Real Estate Services’s indispensable Q1 2018 market reports.

As we have been reporting for the past several quarters, the available supply of quality industrial space in Orange County and Mid-Counties regions has been running dangerously low.

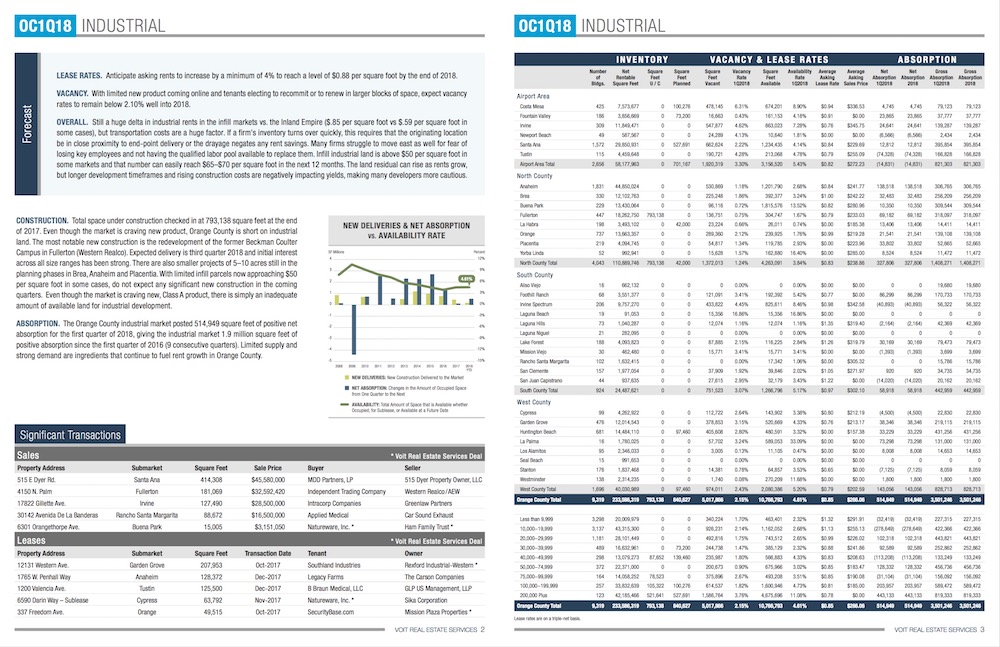

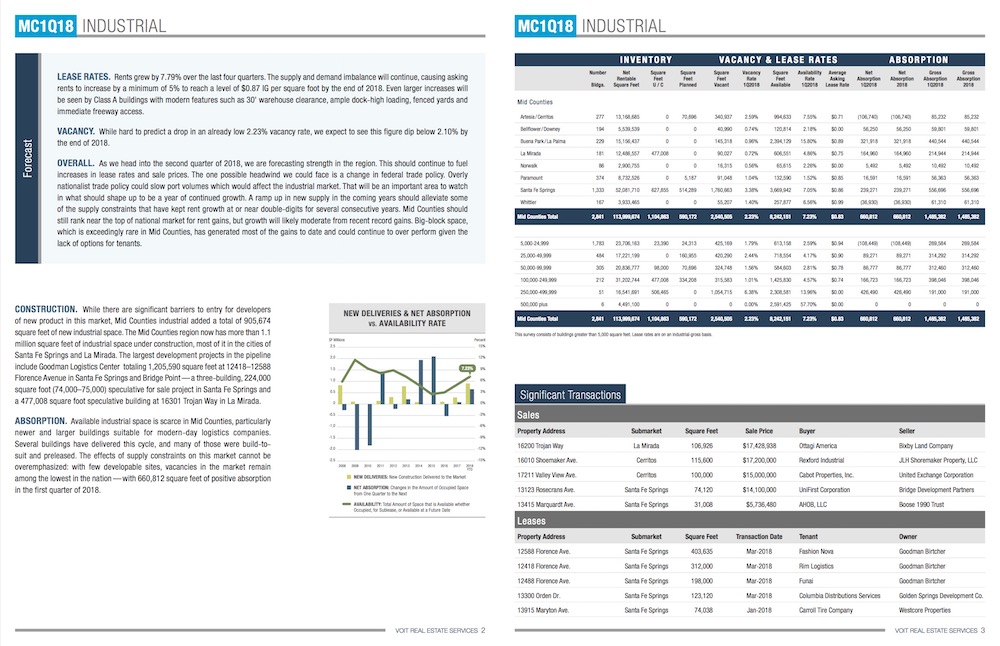

We would like to report to you differently this quarter, but sadly, we are unable to do so. The vacancy rates for the OC and Mid-Counties are 2.15% and 2.23% respectively, and they have been in that range for more than two years, a clear indication that the supply shortage shows no sign of abating anytime soon.

Construction of new inventory remains at a trickle, so there is no relief in the offing on that front. The Beckman Business Park in Fullerton is the only industrial product in the OC construction pipeline offering state-of-the-art space, and that product is expected to move quickly as the eight-building, 976,754 square-foot project nears completion.

The Mid-Counties construction pipeline totals just 1.1 million square feet in two projects, one in Santa Fe Springs and the other in La Mirada. Both projects will absorb quickly due to demand that has tenants competing for good space, driving lease rates further into record territory.

Net absorption remains in positive territory, but is constrained by low supply, which is forcing growing companies to consider leaving the area to meet demand for growth, which continues to be fueled by a strengthening national economy.

That said, the greener pastures of the Inland Empire may not be greener for much longer. The Western Inland Empire is also facing dangerously low vacancy, while the Eastern IE market is a bit softer due to high levels of speculative construction. That means frustrated users from cities like Anaheim, Santa Fe Springs, Cerritos and La Mirada may have to take space more than an hour’s drive east of their current locations, which may create more problems than it solves in the long run.

The wild card right now in terms of change in market demand is the future impact of the Tax Reform and Jobs Act legislation passed back in December.

The number crunching is ongoing and the region’s businesses are evaluating just how to take full advantage of new bonus depreciation rules on capital expenditures, which, by the way, include immediate 100% expensing for tenant improvements made by landlords and tenants. Also, property owners can now fully expense in year 1 the cost of major capital replacements including the roof and HVAC system pursuant to expanded Section 179 rules.

If the economy responds to the new tax law as many expect, supply will tighten further, and that will lead to further increases in rents and sales prices going forward. Tenants and buyers must expect sharply higher occupancy costs going forward and should be looking for other ways to increase operational efficiency as an offset.

Property owners will continue to enjoy the upper hand, but those with shorter term strategies will need to keep an eye on factors that could signal a correction, including higher mortgage interest rates and more aggressive action by our nation’s central bankers.

ORANGE COUNTY – INDUSTRIAL

This in-depth market report rounds up the performance of the Orange County industrial markets in the first quarter of 2018.

MID-COUNTIES – INDUSTRIAL

Download our fully-illustrated and graphed Q1 2018 report for the mid-counties industrial market via the button below.

More:

Leave a Reply

You must be logged in to post a comment.