Review the California real estate market’s performance in the third quarter of 2018 with Voit Real Estate Services’s indispensable Q3 2018 market reports.

Each quarter for the past several years, we have been reporting rising lease rates, higher sales prices, declining vacancy and steady demand that outpaces supply.

On those fronts we have little to the contrary to report relative to the Mid-Counties and Orange County industrial markets in the third quarter. Market fundamentals are mostly unchanged and occupiers of industrial property, whether they be tenant or buyer, continue to face the challenge of finding quality facilities.

Unfortunately, we see no relief in sight for business owners in need of space. Construction remains at a near standstill and the price of existing space, regardless of quality, keeps moving higher, and there are no clear indicators of a market correction that could free up more good space and compel landlords and sellers to soften their positions.

Interest rates on long term financing have risen from the low-4% range to the mid-5% range over the past year without dampening demand or putting a lid on the rise in sales prices. Lease rates continue rising at a double-digit annual pace and landlords are getting away with offering properties as-is where-is with nominal concessions.

Dealing with these realities proactively is the closest thing there is to a solution. Tenants and buyers must allow more time to find their space and perhaps more importantly, look for new ways to gain operational efficiency other than by simply taking more or less space.

Taking a harder look at staying where they are is another viable option. For some, the cost of new materials handling systems to get more out of existing space is offset by eliminating the cost of moving into alternate space. For others, an offer to renew a lease early in return for some assistance from their landlord in completing interior improvements that increase efficiency, is a viable option.

The undeniable truth of it is, the numbers don’t lie and the current reality is likely to continue in the near term. So, if you are a tenant or buyer, stay informed, allow more time to find what you are looking for and be sure of what you need before you commit.

If you are a property owner, you still hold most of the cards. You can demand stronger credit, a higher lease rate or a bigger sales price. But, there is no guarantee against a market correction and this bull run is nearly ten years old.

That makes this a good time to revisit your strategy for your real estate assets no matter what the statistics tell us about current circumstances.

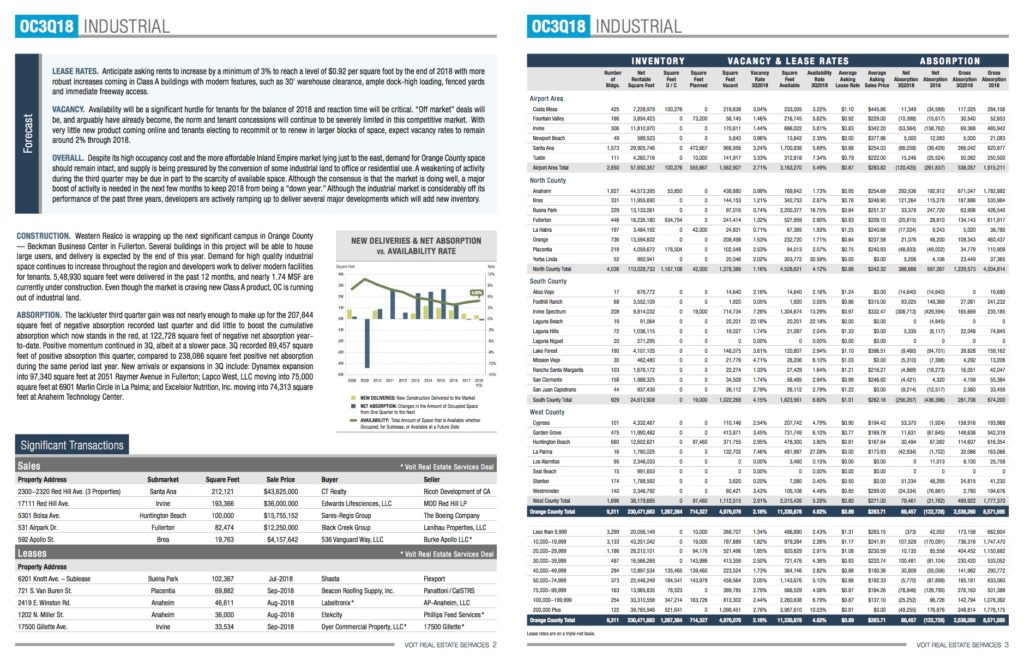

ORANGE COUNTY – INDUSTRIAL

This in-depth market report rounds up the performance of the Orange County industrial markets in the third quarter of 2018.

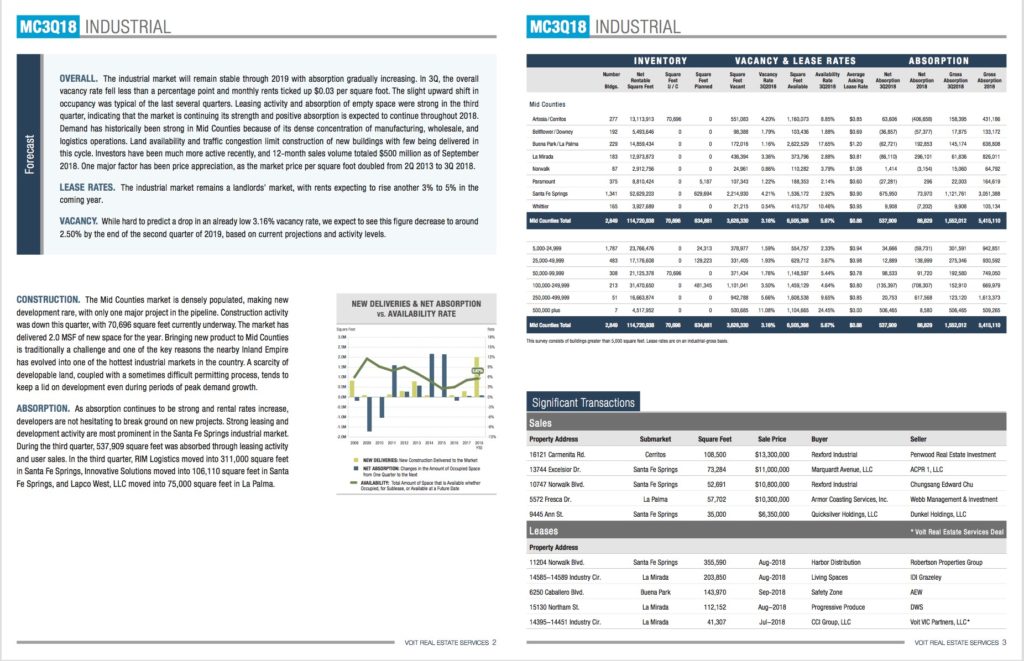

MID-COUNTIES – INDUSTRIAL

Download our fully-illustrated and graphed Q2 2018 report for the mid-counties industrial market via the button below.

More:

Leave a Reply

You must be logged in to post a comment.