Is that costly power panel you’re installing yours to keep when your business moves? That all depends on how it’s defined in your lease: utility installation or trade fixture?

This week we continue our series on important issues related to industrial leases. Past posts in this series addressed maintenance responsibilities for tenants:

We now get into another related topic that is largely misunderstood: Utility Installations vs. Trade Fixtures vs. Alterations.

The need for significant building improvements and modifications is growing because the supply of good quality product is running very thin. As a result, tenants are forced to occupy buildings lacking in modern componentry.

Since landlords have the upper hand in negotiations these days, improving a building to meet operational needs falls to the tenant in most cases.

So, if you are faced with making substantial modifications to your next facility, you will want to pay close attention to this part of your lease agreement to avoid costly surprises down the road. Surprises are great for birthdays and anniversaries, but not when it comes to leasing real estate.

Let’s start with the definition of all three categories according to the AIR Standard Industrial Gross or NNN lease, the most widely used leasing documents in the region:

|

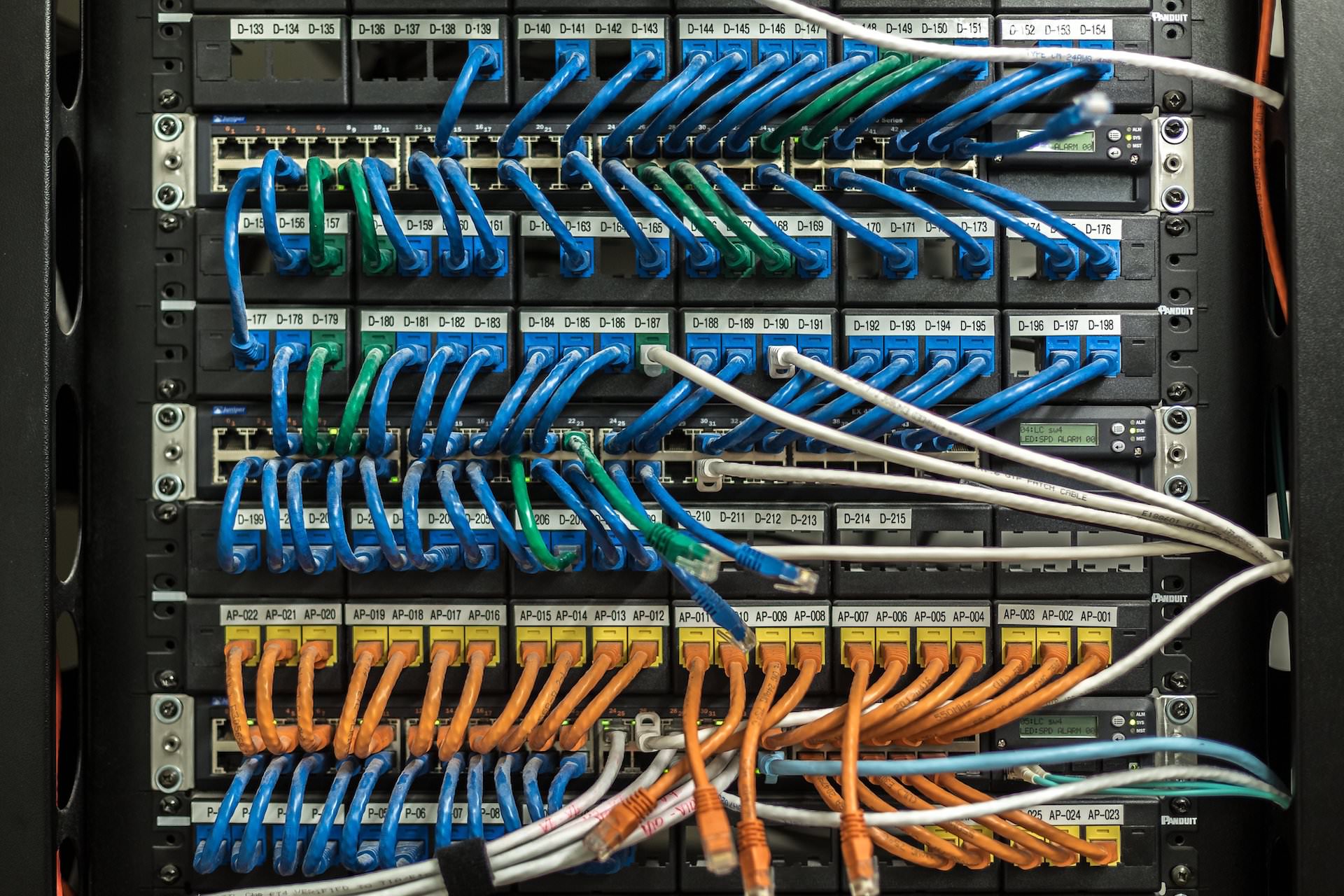

Utility Installations: All floor and window coverings, air lines, power panels, electrical distribution, security and fire protection systems, communication cabling, lighting fixtures, HVAC equipment, plumbing and fencing. Trade Fixtures: Tenant’s machinery and equipment that can be removed without causing material damage to the building. Alterations: Modification of the improvements, other than Utility Installations or Trade Fixtures, whether by addition or deletion. |

|---|

Most tenants are surprised by these definitions, especially when it comes to utility installations. Who would know that vertical blinds in a window or carpet in the office area is considered a utility installation?

Generally we think of utilities as water, gas and electricity, but when it comes to leasing a building that is simply not the case.

The implication of misinterpreting what counts as a utility installation can come as a shocker at the end of a lease. More on that shortly.

Disagreement between the parties to the lease stem mostly from distinguishing between what a trade fixture is versus what constitutes a utility installation. Most tenants think of a new power panel they install to run machinery as a trade fixture. It can be removed without damaging the building and the old panel can be reinstalled at the end of lease.

They are likely to see the distribution of the power to their machines as a trade fixture, as well. We use power as our example here because it is a very expensive and an often-disputed item.

The rub between the parties comes at the end of the lease because Utility Installations automatically become the property of the landlord, while trade fixtures remain the property of the tenant.

Imagine spending $50,000 on a power panel thinking it is yours to keep and then finding out that you are legally obligated to leave it behind. Unfortunately, this happens more than you might think.

How can this problem be avoided? The answer is; plan ahead. Identify so-called Utility Installations that will remain your property at the end of the lease.

If you plan on installing a new power panel or warehouse lighting, re-define them as trade fixtures and agree to restore the original equipment to working condition before you vacate the building. Or, make your case for the landlord to pay for utility installations that will add value to the property beyond the term of your lease.

The time to protect your interests is when the original lease is being negotiated.

Arguing over what a trade fixture is five years down the road is a losing proposition for you as a tenant. You may not get everything you want, but the time to fight the good fight is at the beginning.

Next week, our thoughts on Alterations. Subscribe for email updates below.

Leave a Reply

You must be logged in to post a comment.