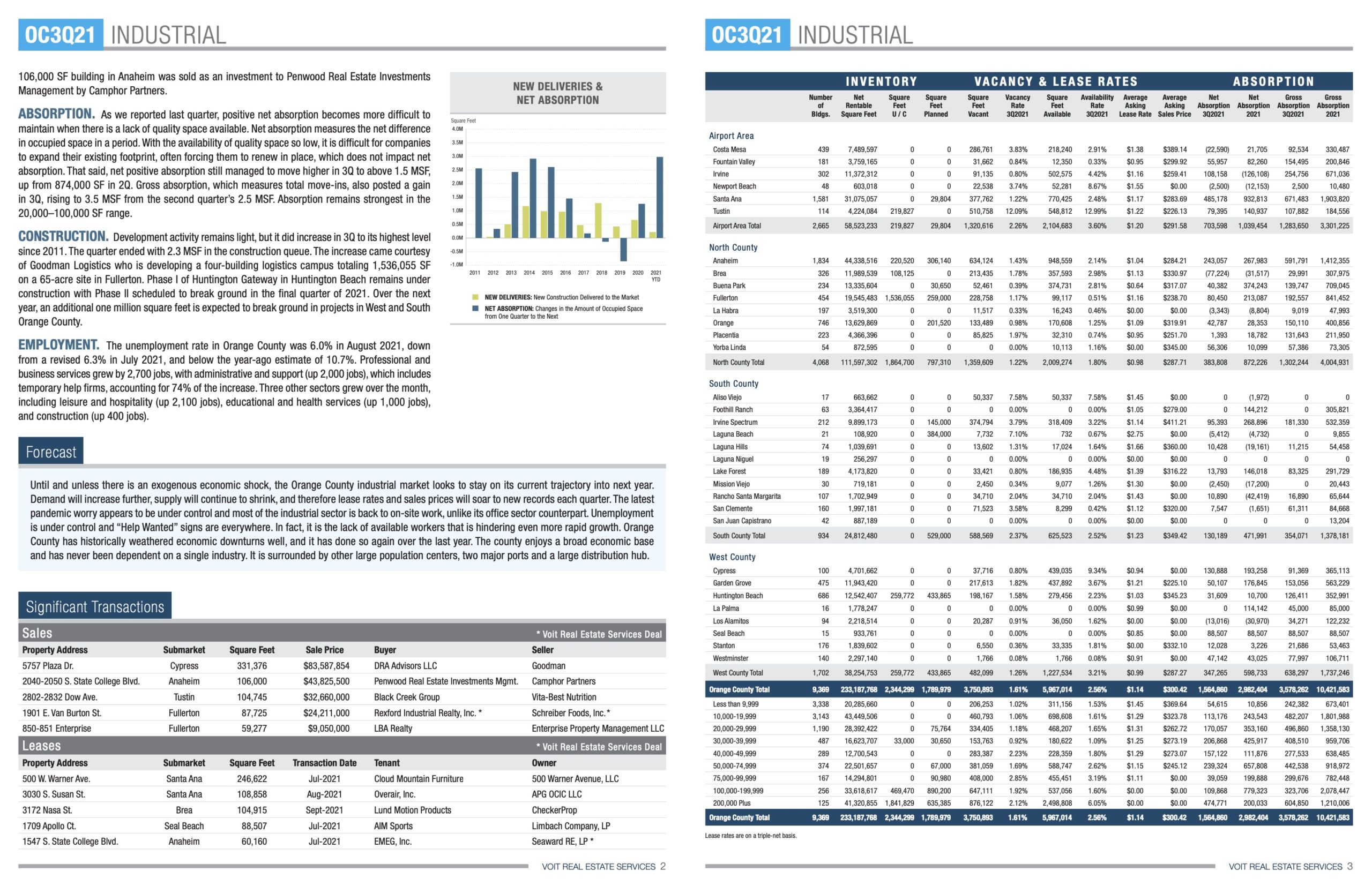

Lack of supply continues to drive industrial real estate prices higher much as the bottlenecks in the supply chain are inflating the price of goods and commodities around the world.

Demand for industrial product for sale or lease intensified again in Q3 as inventory of available space dwindled even further. Industrial users who don’t absolutely have to move are renewing existing leases rather than getting caught up in bidding wars for alternate space.

Orange County and Mid Counties vacancy rates remain at historic lows and many of the deals getting done are completed on an off-market basis. Average asking lease rates and sales prices are not reflective of actual pricing, as a substantial number of the buildings being offered for sale or lease hit the market without an asking price, or are leased and sold well above asking through competitive bidding.

Cap rates for industrial sales are in the 4% range, as investor buyers are underwriting deals at projected rather than actual rents to remain competitive. Interest from institutional investors to acquire industrial property is off the charts, as there is too much money chasing too few opportunities.

Construction of new inventory is also at an historic low point, offering little in the way of supply relief. We don’t expect that to change going forward. Both regions are now infill markets with few ground-up development sites remaining.

Leave a Reply

You must be logged in to post a comment.