These are interesting times we are living in to say the least. The entirety of Q2 fell under the cloud of the COVID-19 virus response that slammed the brakes on economic activity around the globe. Both the Orange County and Mid-Counties markets were impacted, but to varying degrees.

With so many businesses closed and others mired in uncertainty, it is no surprise that sale and lease activity was heavily impacted. Deals inked during the period declined by 60% in Orange County and 39% in Mid Counties. The falloff was due to a combination of larger transactions being put on hold and the disruption to the transaction process itself. However, inquiries and new transaction activity bounced back late in the quarter, which may indicate a near term rebound to a more normal activity level.

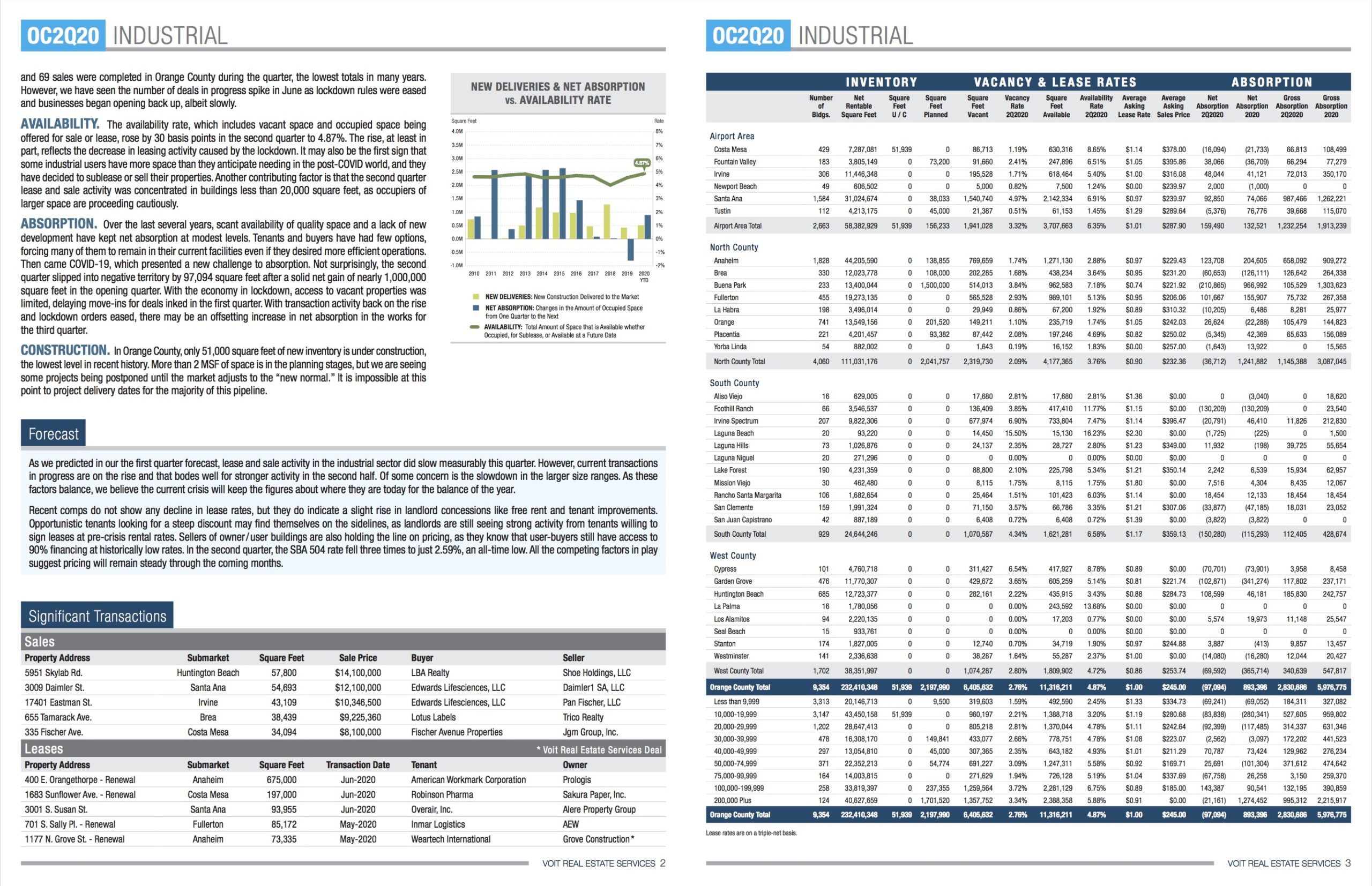

Both regions showed a tick up in vacancy, but are still near historic lows and well under the vacancy rates recorded this time last year. Finding quality functional space for sale or lease is still a challenge. That has kept sales prices and lease rates at current levels, though we do expect prices to level off for the balance of the year. Landlords are focused on securing strong credit tenants and holding the line on coupon rates, but are showing more willingness to negotiate on up-front concessions and shorter lease terms.

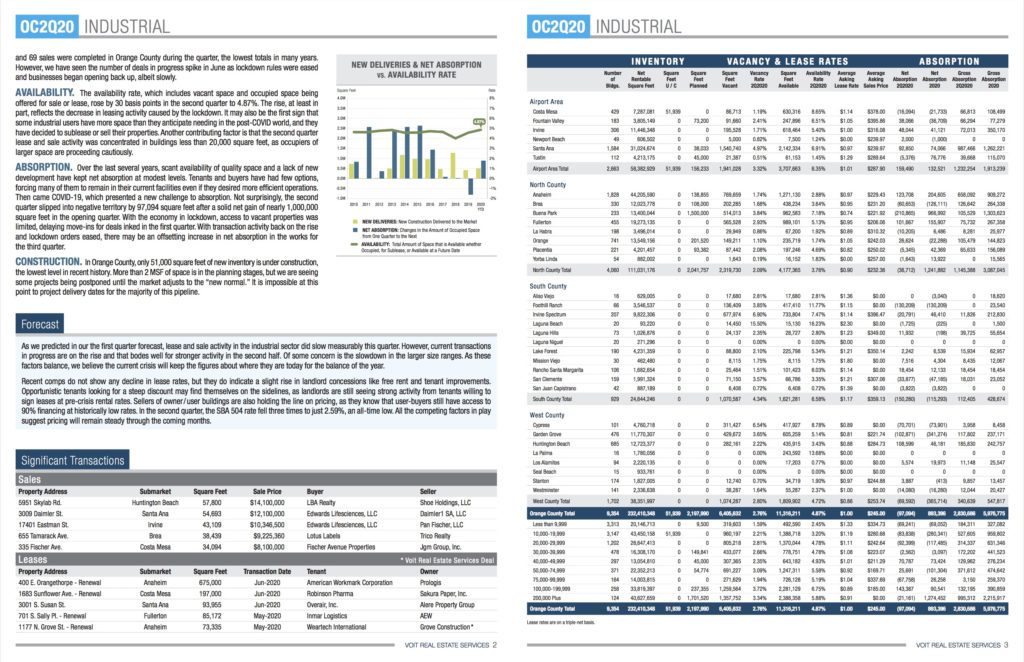

In terms of gross and net absorption, the Orange County market fared better. Gross absorption, which measures total move-ins actually moved slightly higher, but net absorption, the net difference in occupied space between quarters, moved slightly into negative territory in Q2. In the Mid-Counties, gross and net absorption fell sharply in Q2, in large part due to several companies leaving the area to expand into other markets. Year-to-date net absorption in both markets is in positive territory.

Considering the circumstances, the results were better than we expected and with market activity back on the rise, both the Orange County and Mid Counties markets could end the year on the upswing.

Leave a Reply

You must be logged in to post a comment.