Review the California real estate market’s performance in the first quarter of 2017 with Voit Real Estate Services’s indispensable Q1 2017 market reports.

Q1 Delivers More of the Same

Real estate decision making in Orange County and the Mid-Counties region of Los Angeles County remains driven by scarcity.

Both areas are nearing full build-out and the high price of remaining land sites makes building traditional industrial product nearly impossible. What does get built is in the higher size ranges to mitigate rising construction costs, which further exacerbates the problem for occupiers of buildings under 50,000 square feet. That leaves area businesses with a thin choice of aging buildings to choose from.

Last quarter we talked about the importance of “being on the look-out” for any building that could possibly work for your business, even if it becomes available before you are ready to move.

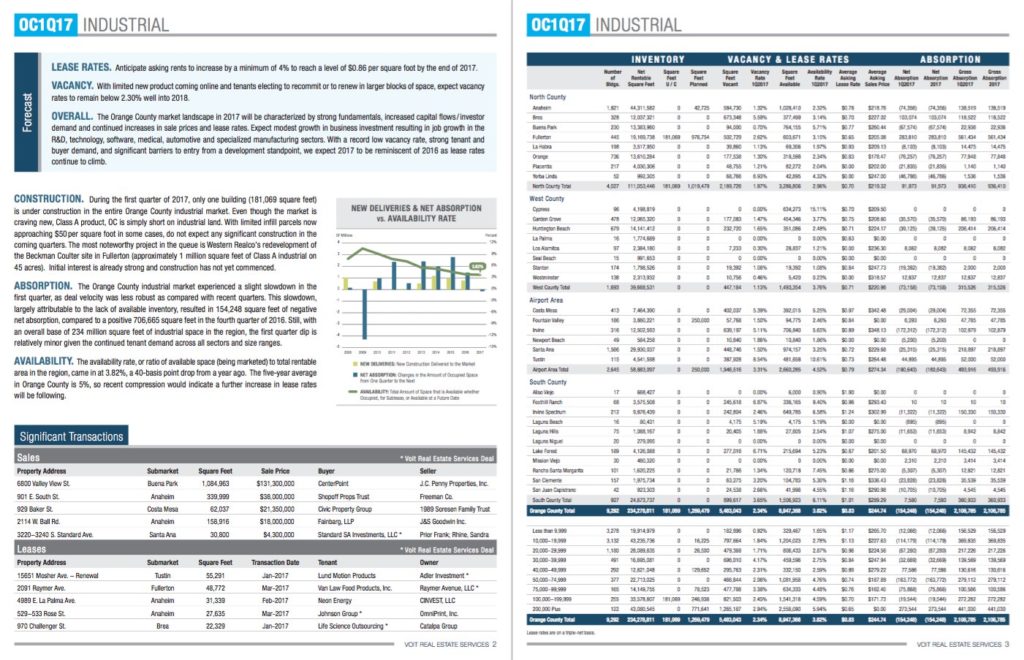

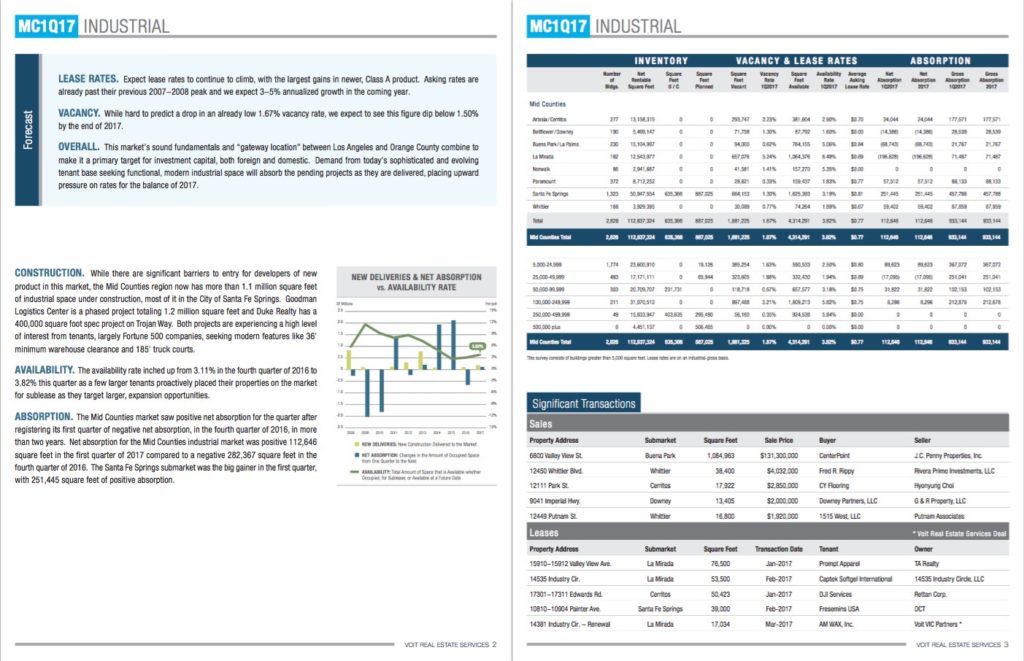

The first quarter of 2017 did little to change our perspective. Vacancy in both market areas stayed at critically low levels and precious little new space is under construction. In all of Orange County, just one building of 181,000 square feet was in the construction queue as Q1 ended. The Mid-Counties market has 1.1 million square feet underway, all of which is likely to be spoken for prior to completion.

Lease rates and sales prices keep moving higher, as well. Property owners are in position to choose from multiple offers, whether they offer their buildings for sale or lease, and price negotiations often end up above asking. Some properties are even being offered without an asking price to encourage aggressive bidding. Both lease rates and sales pricing have eclipsed the 2007 market peak and show no indication of slowing down.

Last year’s concerns over a potential economic correction seem to be fading, at least for the time being.

The surprising November election result buoyed expectations of stronger economic growth, and the industrial market took two Fed rate hikes and a significant rise in mortgage rates in stride. So, we see 2017 as another year of strong rent growth, rising sales prices and limited demand.

Transaction activity and net absorption will be restricted by short supply, but demand will only increase as the economy improves. That means it’s going to get harder before it gets easier for tenants and buyers of industrial properties in both market areas.

So, if you plan to make a move within the next 24 months, stay on the lookout and be ready make a decision when the right space hits your radar.

ORANGE COUNTY – INDUSTRIAL

This in-depth market report rounds up the performance of the Orange County industrial markets in the first quarter of 2017.

MID-COUNTIES – INDUSTRIAL

Download our fully-illustrated and graphed Q1 2017 report for the mid-counties industrial market via the button below.

More:

Leave a Reply

You must be logged in to post a comment.