Dig in to the California real estate market’s performance in the second quarter of 2016 with Voit Real Estate Services’s indispensable Q2 2016 market reports.

Tight Market Presents Further Challenge

Fewer transactions were completed again in Q2, continuing the trend towards lighter overall activity.

The main culprit is lack of supply, as tenant and buyer interest is still running high. This is an ongoing concern because we don’t see this trend turning around anytime soon. There just aren’t enough quality buildings to go around, and that means more business owners will be stuck with existing locations, whether they impact efficiency and profitability or not. Without business expansion, growth in unemployment and wages suffer, increasing the chances that the Orange County economy will move closer to stall speed.

Chapman University’s latest forecast calls for lower job growth for the balance of the year, and the trajectory of several other leading economic indicators is also flattening out.

The US and global economies are an increasing cause for concern, as well. While US GDP gains were expected to be over 2% in Q2, the actual number was a dismal 1.2%. The previous two quarters were also disappointing. Q4 of 2015 came in at a revised 1.4%, and Q1 was even lower at .8%.

Even with a good bounce in Q3, the US growth rate for all of 2016 could come in under 2%, a year-over-year decline.

Europe is getting a lot of attention due to the UK’s decision to exit the European Union, but the bigger story there is the fear of deflation, which has the European Central Bank setting benchmark interest rates in negative territory.

That’s not good no matter how optimistic you are. Europe is also engaged in massive quantitative easing, (printing electronic Euros to buy back sovereign debt) and even buying corporate bonds at negative yields. Imagine borrowing money for your business and having the bank pay you for the privilege. As crazy as that sounds, that is exactly what is happening across the Atlantic.

Cause for concern? We think yes.

Add troubles in China, Japan, Brazil, Venezuela and other countries around the world, and the situation appears even worse. The US Federal Reserve Bank has responded to the global slowdown by parking plans to raise rates. After predicting up to four bumps in the Fed Funds Rate in 2016, there it sits at .5%, right where it was when the rate was raised for the first time in 10 years back in December.

The good news for anyone borrowing money is that rates should stay near their current levels for the next several quarters.

That will give owner/user buyers more time to find the right building to acquire. But, supplies are so low that finding a good quality building to buy is like finding the needle in the proverbial haystack. It takes more time, more patience and a quick trigger finger when that right opportunity comes along.

For sellers, the current state of affairs will keep serving up the opportunity to sell at record prices and reap windfall profits. More and more, we see a willingness for sellers to cash out rather than exchange, as they know that an exchange puts them on the other side of the same bargaining table, left with the prospects of paying a premium to another seller with the same game plan.

When rates do finally move higher, the run-up in values is bound to be impacted. So, owners with plans to sell within five years might be better off to cash out and enjoy the spoils of a record bull run.

Landlords still have the upper hand on lease deals. Lease rates keep moving up and have now gone higher than the previous market peak. They are refusing to offer free rent, calling for longer lease terms and leaving tenant improvements to the tenants to pay for. It is a tough time to be a business on the hunt for a new lease, which is why so many business owners have opted to buy instead.

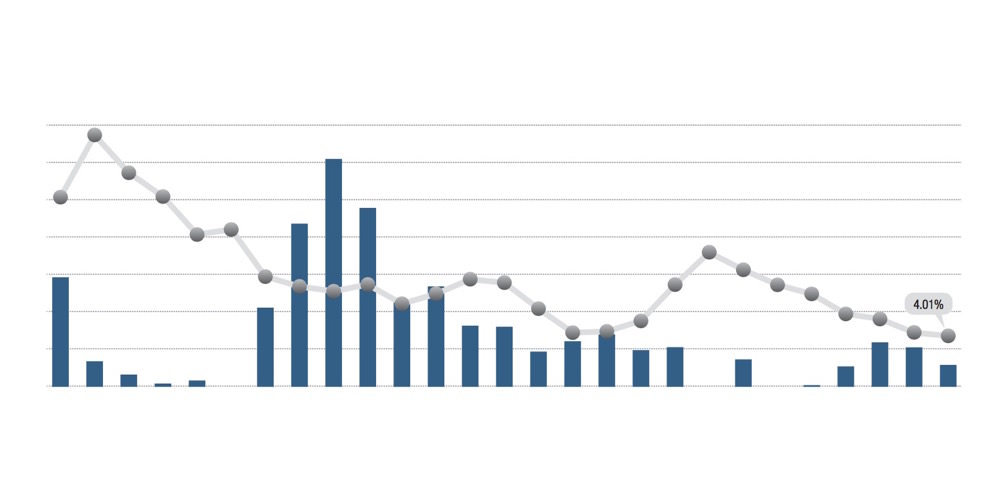

Construction activity is at a virtual standstill. Just 42,000 square feet of industrial space is currently underway, a single building in Huntington Beach. Another 1 million square feet of space is on the books as planned, but over 60% of that is in buildings over 200,000 square feet, which will offer little relief to the vast majority of small businesses in Orange County.

Land prices have skyrocketed and developers are having a hard time figuring out how to make a profit worth the risk, despite the highest lease rates in Orange County history.

What little development there is will be in buildings larger than 40,000 square feet, as smaller buildings are just too expensive to build and site coverage is just too low.

In 2015, our team made a new commitment to increasing the value we can add for those we serve. We encourage you to visit this blog often, which is focused on current trends and events that may help you gain a deeper understanding of the industrial market. Or, just give us a call. We are here to help.

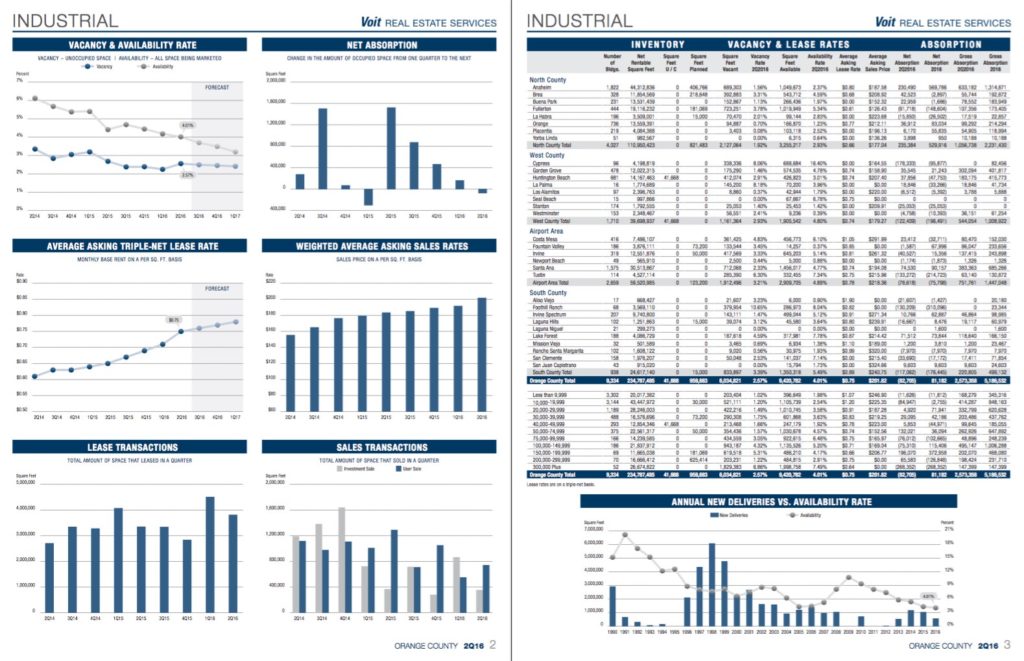

ORANGE COUNTY – INDUSTRIAL

This in-depth market report rounds up the performance of the Orange County industrial markets in the second quarter of 2016.

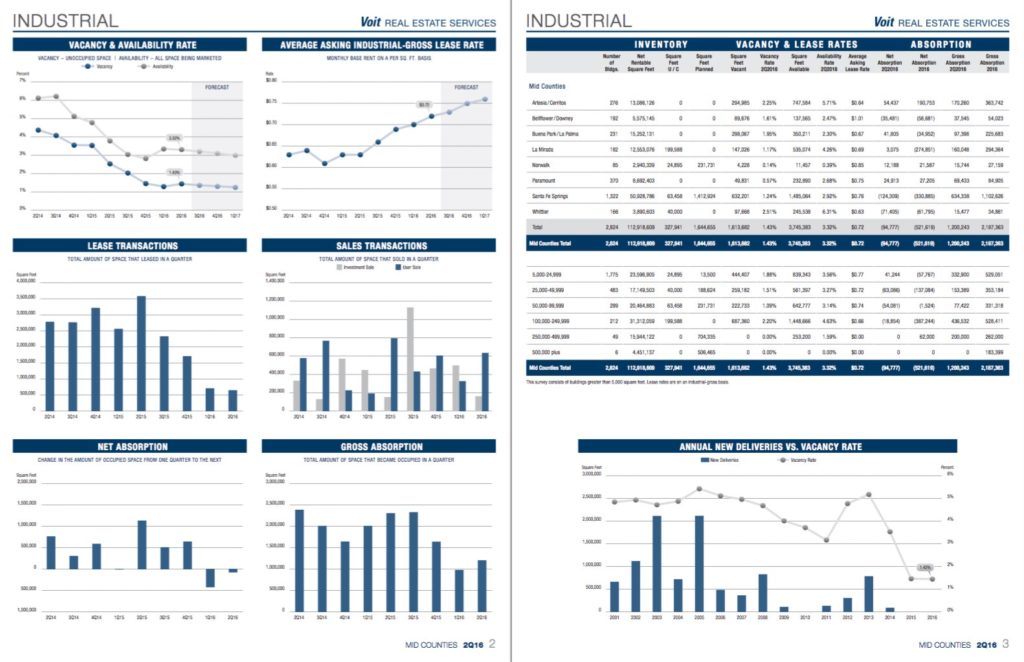

MID-COUNTIES – INDUSTRIAL

Download our fully-illustrated and graphed Q2 2016 report for the mid-counties industrial market via the button below.

More:

Leave a Reply

You must be logged in to post a comment.