The first few months of the year are over, which means Voit Real Estate Services indispensable Q1 2016 market reports have been released.

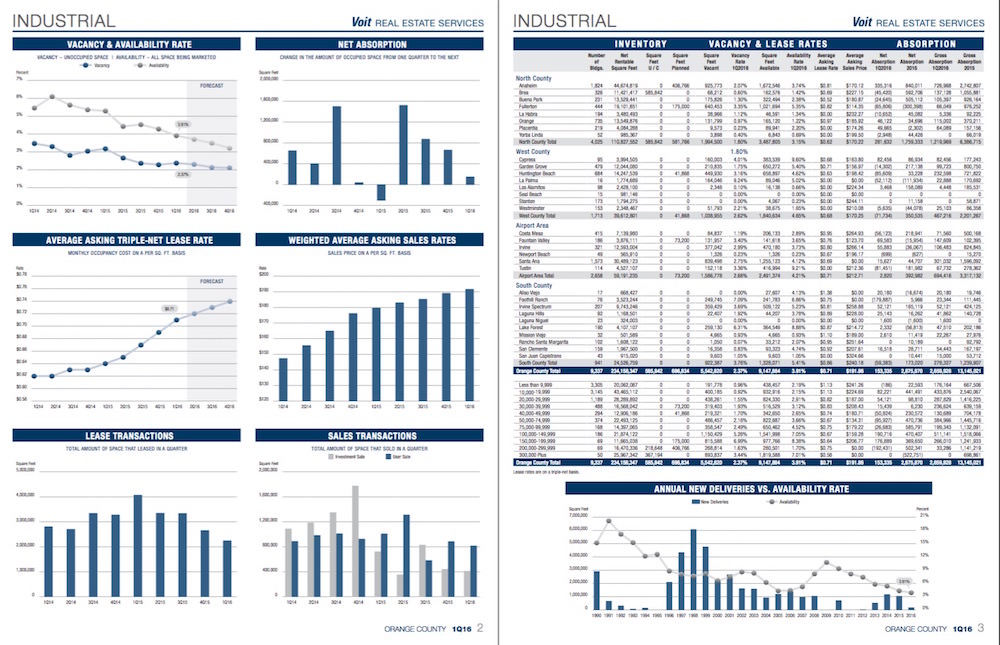

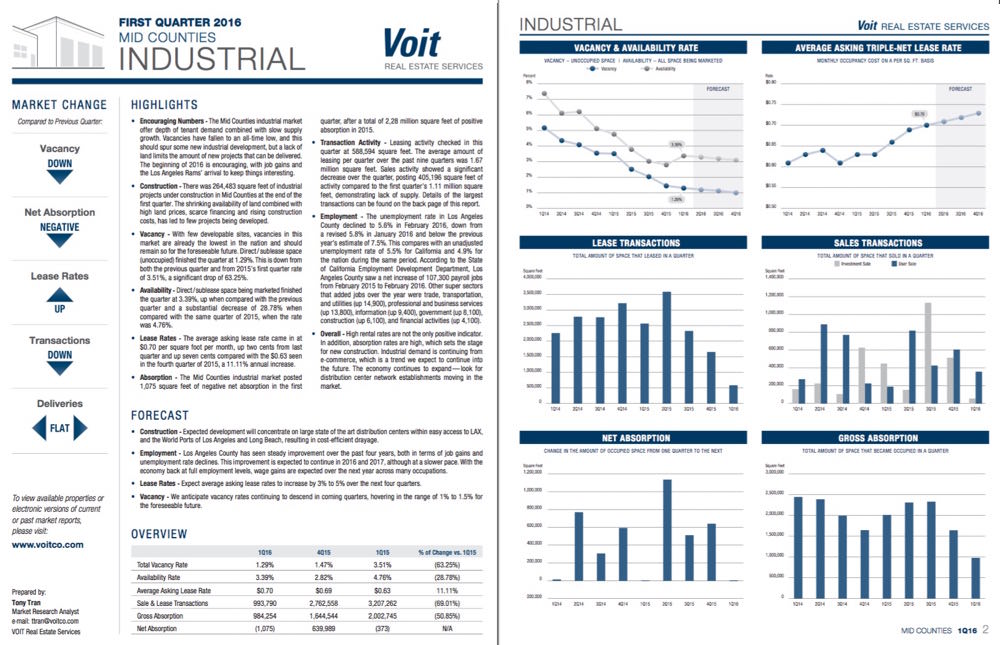

These in-depth market reports round up the performance of the Orange County and Mid-Counties industrial markets in the first months of 2016, and include all the fully-illustrated and graphed data you would expect from Voit.

We’re happy to make them available to you on this page for browsing and downloading, along with our commentary on what Q1 has shown us about the future of these markets.

ORANGE COUNTY – INDUSTRIAL

Feeling the Pinch

For the past year, we have been predicting a significant decline in transaction activity and net absorption (the increase or decrease in total occupied space in a given period) due to an acute shortage of quality space. Unfortunately, that time has come, but not due to a lack of demand.

Vacancy remains at critically low levels, just 2.37% by the end of Q1, leaving expanding companies with too few quality alternatives when it comes to relocation. Instead, more businesses are being forced to remain in existing locations and make due with facilities that no longer offer the efficiency needed to improve profitability.

When quality properties do hit the market, competition becomes fierce and lease rates are bid up. As a result, the average asking lease rate in Orange County rose by nearly 11% in just the past year. Sales prices have moved up even faster, but that hasn’t stopped owner/user demand, mainly due to the availability of low interest loans for up to 25 years.

For property owners who don’t have time to wait out another correction, market metrics favor a decision to sell, as every closed escrow sets a new price record. For owners with longer term strategies, there is opportunity to push for stronger credit from prospective tenants and higher annual rent increases.

Looking ahead, we see more of the same: higher lease rates, higher sales price, record low vacancy and almost no construction. Every user looking to buy or lease in the next year should already be actively looking for the next home for their business.

Full Report

MID-COUNTIES – INDUSTRIAL

Running On Empty

The Mid-Counties industrial market was running on fumes in the first quarter. The heavy hand of low vacancy has really put the hurt on businesses who need space and need it to be in the immediate area.

For the first time ever, the vacancy rate in this 113 million square foot market spent two consecutive quarters at less than 1.5%. It fell another 20 basis points to 1.27%. It’s good to be a landlord these days, but the virtual absence of quality space in the market is giving tenants fits and raising the danger that they will be forced to move elsewhere as leases expire. In the long run, that’s not good for anyone.

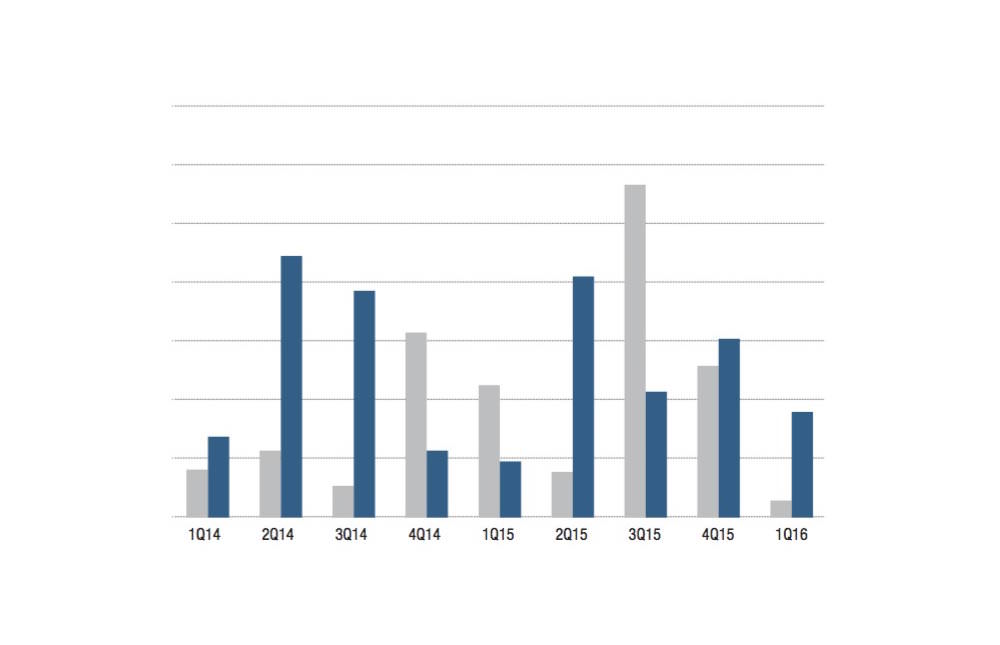

The other option is stay in space that has become inefficient and that reality is showing up in the absorption and leasing/sales transaction stats. Net absorption (the net difference in occupied space in a period) came in at a paltry 1,075 square feet in the first quarter. Leasing/sales transactions (the total amount of square footage leased or sold in a period) hit 994,000 square feet, but that was less than a third of the total for Q1 of 2015. There is simply no place to go.

With construction activity at just 264,000 square feet, supply will just keep running shorter and shorter going forward, and that means lease rates and sales prices will keep moving up. The average asking rental rate in the region moved up a whopping 11% in Q1. Tenants and would-be buyers need to be on the lookout at all times, and be ready to aggressively pursue any space that even comes close to a good fit.

Gone are the days of securing a new space just in time to coincide with a lease expiration.

Full Report

More:

Leave a Reply

You must be logged in to post a comment.